Cigarettes are a substantial source of income for governments around the world. With such a large percentage of each pack coming from the “sin tax” applied to cigarettes and still-substantial numbers of smokers in most countries, it’s no surprise the money adds up. And in a sense, it’s also not much of a surprise that state governments and the federal government have been considering taxes on vaping for some time now. In fact, 20 states currently have some form of e-cigarette tax already in place and there is a federal-level bill proposing a nationwide vaping tax.

The justification is easy for smoking. Since it kills you, and raising taxes generally discourages people (especially youths) from buying cigarettes, it passes as a legitimate public health move rather than a desire to tax “sin” for the sake of it. But for vaping things aren’t quite as simple. Of course, lawmakers considering imposing taxes on vaping either try to use the scare around the “vaping-related” deaths (that weren’t linked to e-cigarettes) or just apply the exact same argument with more of a focus on preventing youth vaping.

But there could be unintended consequences of any move like this, in particular the risk of people going back to smoking or never quitting. And a new study has found just that. Among other things, the study estimates that for every vape pod (i.e. a Juul pod) not purchased, there would be an increase in cigarette sales by over six packs.

The Study – What They Did

The researchers on the paper (full version here) used Nielson retail scanner data from 2011 to 2017 to look at sales data on e-cigarettes, cigarettes, cigars, chewing tobacco and loose tobacco. This data covers more general retail stores, but not online or brick-and-mortar vape stores. Since there is a huge variation in types of vaping products, the researchers used the amount of e-liquid to help them make comparisons between different devices and products. Everything else is much easier because they just used the number of packs for cigarette sales, ounces of chewing tobacco and so on.

They also gathered data on e-cigarette taxes across the country, over the period covered by the Nielson data. They also collected data on traditional cigarette taxes and some other tobacco control policies to use in the analysis.

If you want more details on the calculations, the full paper is very detailed, but the short version is that they used a set of mathematical models to look at the impact of the taxation on prices and sales of vaping products and traditional tobacco products.

Taxes Vary Massively Across the Country

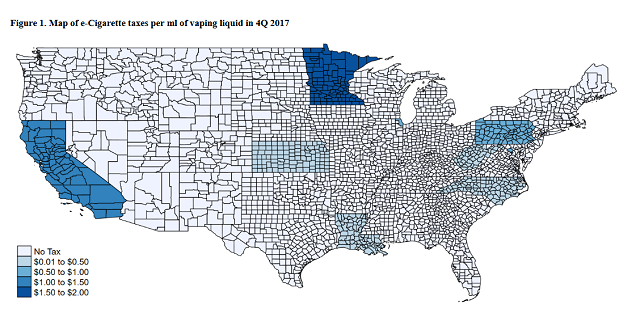

Although it’s a very surface-level finding, it’s worth stressing how much variation there is in the e-cig taxes levied by different states. For example, some states charge as little as $0.05 per ml of liquid, while DC’s vaping tax is set to be the same as the tax on traditional cigarettes. The average tax amount for the period covered in the study is $0.68 per ml, but this depends a lot on whether the taxes are excise (at the time of manufacture) or ad valorem (at the time of sale), with the ad valorem taxes generally being much higher.

California, Minnesota, Montgomery County (Maryland), Pennsylvania and Washington DC had an ad valorem tax during the study period, while Kansas, Louisiana, North Carolina, West Virginia, Cook County and Chicago had an excise tax.

The nationwide tax being considered would raise the cost of vaping by $2.54 per ml, over three and a half times the average state-wide rate.

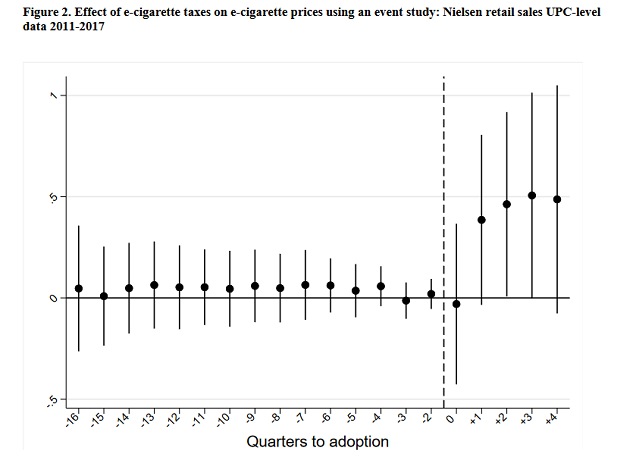

Costs Get Passed on to Customers (Plus a Little Extra)

The paper looks at the effect of tax increases on the prices of e-cigarettes, and of course consumers bear the brunt of this. What’s worse, though, is that for a $1 tax increase, the price of vaping increases by $1.31 for consumers, or even more when the researchers accounted for different effects. Essentially, lawmakers and the retail stores covered in the Nielson data are both earning money from the customers when they raise the tax. Specialty vape stores aren’t included in the sample, but it isn’t a big leap to say some of them will be using it as an excuse to raise prices too.

This is kind of normal for “sin” taxes, though. The researchers point out that the same thing happens with combustible cigarettes, alcohol and sugary drinks when taxes are applied. This doesn’t make it any less annoying as a consumer, but it’s nothing unusual.

Tax Increases Reduce Sales of E-Cigarettes

Another expected result is that increasing the cost of vaping product leads to less people vaping, and this is basically how lawmakers pitch these tax increases. So in a sense they’re right in what they say, it’s just based on the false assumption that people vaping is actually a bad thing because [chemicals/gateway effects/addiction/the children/insert anti-vaping talking point here].

The results will really match their intentions if taken out of context. For every 10 percent increase in the cost of vaping, sales of e-cigarettes reduce by 26 percent, and if that’s what you’re looking for when proposing a policy, it will “work.” It’s important to remember that this is just for non-specialist retailers, but of course it will hit sales at vape stores too. The result will definitely be fewer sales of vaping products.

But that isn’t the whole story…

Raising Taxes on E-Cigarettes Boosts Cigarette Sales

The problem with the theory behind increasing taxes on vaping to “help” public health is how it affects cigarette sales. When you apply that same 10 percent tax increase to vaping, sales of cigarettes increase 11 percent as vaping declines. Consumers smoke more when you encourage them to vape less through tax increases.

The researchers calculate that for every 0.7 ml pod of e-juice that isn’t sold (they were focused on the Juul for this calculation), there will be 6.2 extra packs of cigarettes sold. Comparing these two outcomes based on any metric – even just the amount of nicotine, but especially risk – shows how counter-productive any policy like this is.

We do not live in the fantasy world created by opponents of vaping and tobacco control advocates –reducing vaping will not mean that all of those people quit using nicotine altogether. The data also shows that an increase in taxes on cigarettes leads to an increase in e-cigarette sales. They act as “substitute goods” in economic terms, so people use one or the other based on availability or other factors. Of course some people will stop if you increase taxes on one, but it’s more likely that people will switch between them.

So you are left with a choice, as a politician wanting to raise taxes on vaping or smoking: do you tax the dangerous one and cause sales of the safer one to increase, or tax the safer one and increase sales of the dangerous one?

Generally, they choose the third option: both of them. But it’s obvious what the reasonable choice is, even before getting into issues like encouraging black market sales.

About That Federal Tax…

Study author Michael Pesko, commenting on the results in light of the proposed federal tax, sums it up: “The public health impact of e-cigarette taxes in this case is likely negative.”

The problem is that a rational look at the facts and the nuances behind the decision is not the driving force behind such proposals. In their minds, vaping is a threat and it needs to be stopped. Children are vaping. People are getting sick. So you have to do something – anything – or at very least look like you’re doing something.

And that is ultimately why this study won’t stop the tax from happening, and why the exact same arguments (which vapers and advocates have been making for years) usually don’t quash state-level taxes either. The more information like this study out there, the better, but it’s hard to be too optimistic about what facts can achieve in this debate.

But the facts are clear, regardless. A federal vaping tax would lead to less vaping, but that would be more than compensated for by increases in smoking. And the companies wouldn’t pay the cost, we would.